Parler

Parler Gab

Gab

China expanding influence in EV market

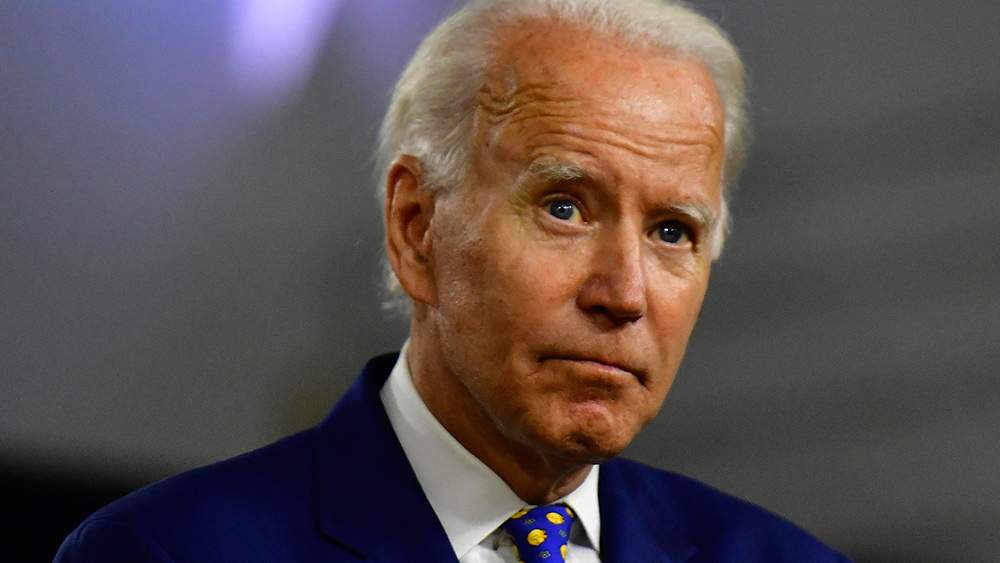

The move comes amid heightened scrutiny by U.S. lawmakers and the Biden administration of technology collaboration with China in a number of fields, including production of batteries. Tesla's purchase may sidestep criticism about U.S. companies' dependence on Chinese partnerships because of CATL’s minimal involvement. Biden's Inflation Reduction Act was designed primarily to offset China's dominance of lithium-ion battery production worldwide. As per the New York Times, a switchover to sodium-ion batteries may make the East Asian nation's control over battery manufacturing even greater, reported NaturalNews.com. Meanwhile, consulting firm Benchmark Minerals revealed that of the 20 sodium battery factories planned or already under construction around the world, 16 are in China. By 2025, the communist country will have nearly 95 percent of the global capacity to make sodium batteries. However, experts are seeing one problem for China. The nation controls much of the sources of lithium worldwide but has little access to soda ash, which is the main source of sodium. The U.S. accounts for over 90 percent of the world's readily mined reserves of soda ash. In fact, beneath the southwestern Wyoming desert, there is a vast deposit of soda ash that was formed 50 million years ago. China currently houses the largest manufacturers of LFP batteries, including BYD and CATL, which supply Tesla. Panasonic partnered with Tesla on the Gigafactory in Nevada with investments in the production equipment, which the Japanese supplier uses to manufacture and supply the EV maker with cells. Visit RoboCars.news for more news on electric vehicles. Watch this video to learn about how Chinese electric vehicles are taking over global EV markets. This video is from the Vanguard86 channel on Brighteon.com.More related stories:

Over 1.1 million Tesla electric cars in China RECALLED over dangerous braking defect. Ford’s deal with Chinese EV battery maker sparks security concerns. Widow SUES Tesla over “dangerous” electric vehicle that KILLED HER HUSBAND. Chinese electric car manufacturer BYD OVERTAKES Tesla as world’s top seller of EVs. Tesla to expand lithium refining capacity to meet growing demand for EV batteries. Sources include: Bloomberg.com Finance.Yahoo.com Brighteon.comGovernments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share