Parler

Parler Gab

Gab

- The U.S. will exempt some car parts from aggressive tariffs after auto industry lobbying, though a 25 percent levy on foreign-made cars and parts remains.

- Automakers argued that overlapping tariffs could disrupt supply chains, raise prices and cost jobs, prompting the administration to adjust its stance.

- Executives like Stellantis' John Elkann warned that tariffs risk harming both U.S. and European car industries, urging policymakers to avoid compounding duties.

- The exemptions follow earlier carve-outs (e.g., consumer electronics) and suggest Trump is softening some trade measures amid economic concerns.

- While the exemptions offer temporary relief, key tariffs remain and industry leaders seek clarity and consistency in trade policy moving forward.

Auto giants unite against tariffs

Trump initially imposed sweeping tariffs – up to 50 percent on some imports – on April 2, dubbed "liberation day," before scaling them back to a 10 percent baseline for 90 days. Auto tariffs, however, remained a sticking point, with a separate 25 percent levy on parts set to take effect May 3. While vehicles complying with the U.S.-Mexico-Canada Agreement face reduced duties, industry groups warn that additional costs could cripple suppliers already in financial distress. Six major auto trade organizations recently united in a rare joint appeal, arguing that further tariffs would destabilize production and harm U.S. manufacturing. The debate also highlights tensions over trade with China, where Trump has linked tariffs to fentanyl chemical exports. Auto parts from China currently face a 20 percent duty under this policy, alongside steel and aluminum tariffs, but would avoid the higher "reciprocal" rates. Meanwhile, Trump hinted at escalating measures against Canada, stating, "We don't want your cars. We want to make our own." Yet the exemption discussions suggest pragmatism is prevailing – for now. General Motors CEO Mary Barra summed up the industry's plea: "I need clarity, and then I need consistency." As negotiations focus on simplifying sourcing rules, the broader question remains whether these concessions signal a lasting de-escalation or merely a tactical pause in Trump's trade wars. For automakers, the relief is a temporary victory. But with key tariffs still looming, the road ahead remains uncertain. Watch former Chrysler CEO Bob Nardelli lauding the Trump administration's move to exempt car parts from heavy tariffs in this Fox Business report. This video is from the TrendingNews channel on Brighteon.com.More related stories:

Trump's sweeping tariffs set to hit consumers hard — from iPhones to automobiles. Trump warns of harsher tariffs on Canada, EU if they try to harm U.S. economy. Trump's 25% auto tariffs shake industry, but Tesla stands strong. Sources include: ZeroHedge.com FT.com CNBC.com Brighteon.comTrump’s tax cut ambitions clash with Ukraine deadlock amid economic optimism

By Willow Tohi // Share

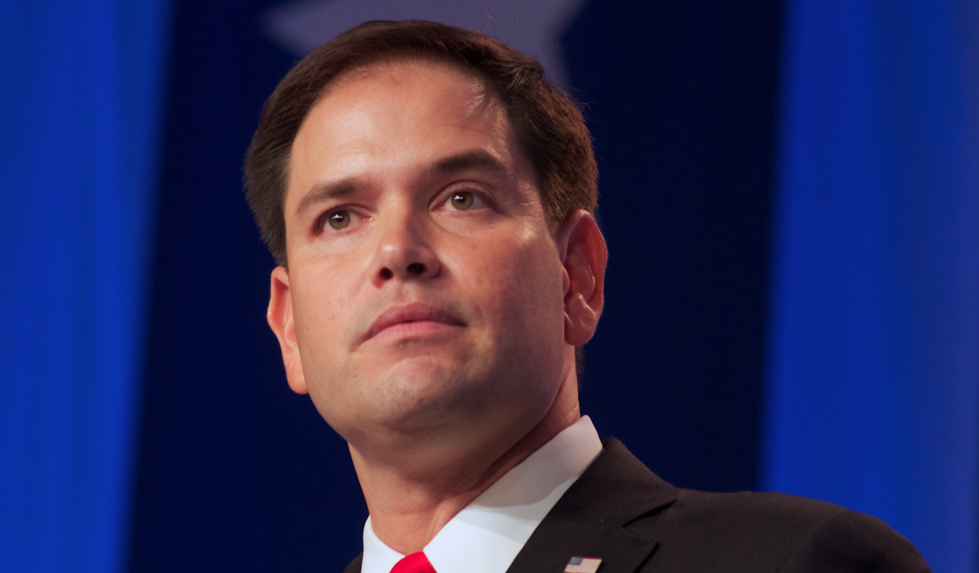

Rubio exposes Biden’s surveillance of American dissent: Outrageous free speech violations

By Willow Tohi // Share

Trump announces total trade embargo on China, sparking fears of economic collapse

By Finn Heartley // Share

U.S. and Ukraine finalize minerals deal, but skepticism lingers over repayment claims

By Cassie B. // Share

Walmart pledges $350B to American-made goods in push to reshore supply chains

By Cassie B. // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share