Parler

Parler Gab

Gab

Medical debt crisis grips America

Several reports from different organizations backed the claims of Lamont and proved that the medical debt crisis is gripping America. National data from the Centers for Disease Control and Prevention (CDC) in 2021 revealed that 10.8 percent of Americans struggled to pay their medical bills in 2023. A KFF-Peterson Health System Tracker analysis estimated that around 23 million adults or nine percent of the adult population, owed more than $250 in health costs. "People who have medical debt may pay off these bills by taking on other forms of debt, including credit cards and bank loans, or negotiate payment plans with healthcare providers, or just fail to pay them. However, medical debt continues to be the major form of debt in the United States," the report reads. A 2022 report conducted by the Consumer Financial Protection Bureau (CFPB) identified medical debt as the leading cause of bankruptcy in the United States, which impacts around 20 percent of Americans or roughly 66 million people. (Related: National debt hits record-high $32 trillion two weeks after suspension of debt ceiling.)More related stories:

DEBT REVOLUTION? Tens of millions of student loan borrowers stage "massive student debt strike."

US could default on its debt by July if deal on raising the debt ceiling is not reached.

Credit card DEBT has SOARED, thanks to BIDENFLATION.

Sources include: TheEpochTimes.com ABCNews.comDems are taking out Biden, and they used the disastrous evening presser to “seal the deal”

By News Editors // Share

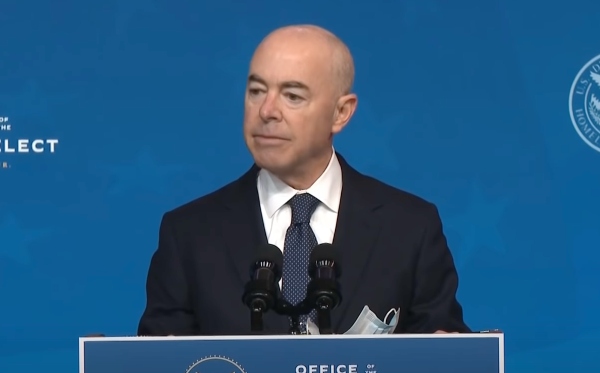

Gaslighter Mayorkas “washes hands” and denies responsibility for the border crisis

By Belle Carter // Share

Kyiv is running out of ammunition as Western aid packages hit roadblocks

By Belle Carter // Share

Republicans should ally with the American people – not Washington Democrats

By News Editors // Share

Boris Johnson has meltdown after being exposed for sabotaging Ukraine peace deal

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share