Parler

Parler Gab

Gab

Job loss numbers don't include smaller regional banks

Keep in mind that the FT report only looked at the world's 20 largest banks, excluding all others, including smaller regional banks. Many of these smaller regional banks likely imposed job cuts as well, which means the true number of bank job cuts in 2023 is much, much higher. Could it be that there are already more people who have been laid off from their finance jobs this time around than were let go in 2007 and 2008? It is difficult to say, but not out of the realm of possibility – and it is important to remember that more job cuts across all sectors are likely in 2024 as well. Switzerland's UBS bank, which merged with failed Credit Suisse in 2023, reported the most job cuts of all. Metro Bank, a smaller bank, laid off a greater percentage of its workforce in 2023, while UBS laid off the most people by quantity in 2023. Further down the list as far as job cuts went in 2023 is Goldman Sachs in third place, followed by Morgan Stanley, Wells Fargo, Canadian Imperial Bank of Commerce, Average, Lloyds Banking Group, PNC, Toronto-Dominion Bank, Westpac, Bank of Nova Scotia, Bank of New York Mellon, Barclays, Commonwealth Bank of Australia, Citigroup, Royal Bank of Canada, Bank of America Merrill Lynch, NatWest, Deutsche Bank and JPMorgan Chase. On Wall Street, around 30,000 jobs were cut this past year as well. "The revenues aren't there, so this is partly a response to overexpansion," Thacker further explained. "But there is also a simpler explanation: political cost-cutting." According to Gaurav Arora, global head of competitor analytics at Coalition, 2024 will "be a continuation of the story of 2023," suggesting the worst is still yet to come. "When does the federal government shrink?" asked a commenter on a story about the ongoing banking crisis. "I just read that they GREW last quarter," responded another about how the public sector always seems to expand while the private sector shrinks. "Get a real job that produces things of value, you parasites," expressed another, speaking directly to the world's finance desk jockeys. "Most banks are already 50% overstaffed and have way too many branches," added someone else to the conversation. "This year (2024) is going to be the year of great layoffs and firings." What will America look like in 2024 and beyond? Find out more at Collapse.news. Sources for this article include: ZeroHedge.com NaturalNews.comDespite Western sanctions, Russia’s economy not only survived in 2023 – IT GREW

By Kevin Hughes // Share

Over 55,000 companies shut down in France as country’s economy implodes

By Richard Brown // Share

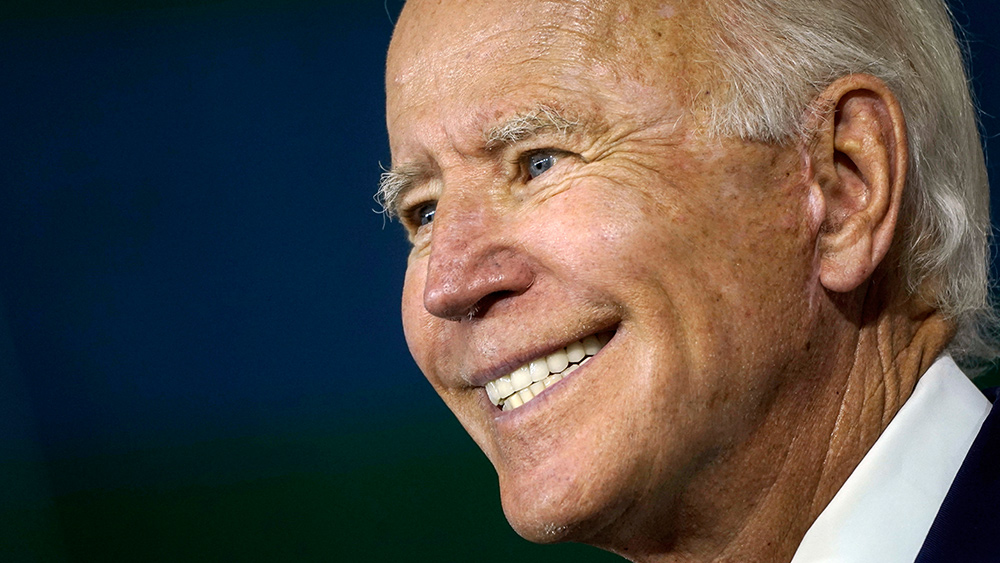

Biden Administration implements new regulations totaling $1 billion in early 2024

By News Editors // Share

Morgan Stanley DOWNGRADES U.S. dollar rating — bad times ahead?

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share