Parler

Parler Gab

Gab

Fed plans to keep raising interest rates

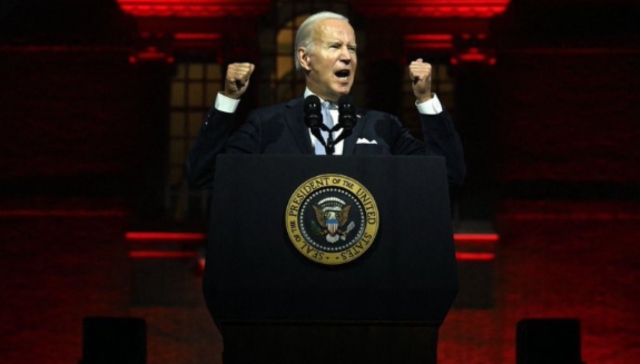

Fed officials raised its key short-term interest rate by half a percentage point in December, marking a step down from four straight three-quarters-point increases. However, it also signified plans to keep raising interest rates next year to keep on reducing high inflation by slowing economic growth. According to an article by USA Today, the central bank is slowing the pace of the rate hikes this year to better allow it to assess the effects of the aggressive moves, including whether they're about to tip the U.S. into a recession next year as most economists predict. Even a normally conservative futures market that predicts interest rate movements doesn't believe the Fed. It figures the Fed will halt its rate increases at about 4.8 percent as inflation throttles back and the economy worsens, according to CME Group. Follow HousingBomb.com for more news related to the collapsing real estate and economic conditions in the United States. Watch the video below that talks about Fed's accelerated interest rate hike plan. This video is from the Sanivan channel on Brighteon.com.More related stories:

GETTING WORSE: Housing market under Biden now collapsing; farmers warn of food shortages due to high diesel prices. South Florida's mortgage payments have risen 96.5% over the past year. Redfin: House sales decline in Sun Belt as buyers back out due to hefty prices. Luxury home sales suffer biggest decline in 10 years, real estate firm reports. New single-family home sales plunge to 6 1/2 year low as mortgage rates and housing prices continue to rise.Sources include:

WSJ.com JournalRecord.com USAToday.com 1 USAToday.com 2 Brighteon.comU.S. spreads misery across the globe imposing sanctions on a third of humanity

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share