Parler

Parler Gab

Gab

China looking to diversify holdings with recent gold purchase

Bloomberg News wrote that the need to diversify its holdings "has rarely been greater" for China. Most of the country's foreign reserve holdings are dominated by the U.S. dollar. But with tensions rising in recent months, Beijing may be considering reducing its reliance on the strength of the dollar. "This is a continuation of the trend for China. The central bank continues to use gold to diversify their reserves," said Juan Carlos Artigas, global head of research at the World Gold Council. "I don't think this is unusual activity for China." Giovanni Staunovo, an analyst for investment banking company UBS Group AG, noted that China still has a lot more room to grow if it is looking to further diversify its assets. "Gold holdings in China as part of the total reserves are still very low, so there is probably room for further purchases down the road," he said. But Marc Chandler, managing director at Bannock Global Forex, noted that China's recent gold purchase is still a drop in the bucket compared to the country's overall reserves. "It sounds like a lot, but if the issue is for diversification, it's minor," said Chandler. "I think the dollar's role as a reserve currency is safe and the diversification out of the dollar into gold is modest and inconsequential for the dollar and probably for the gold market itself." China's most recent announcement comes after three years of not reporting gold purchases. The communist nation seldom reports its gold purchases on time. In mid-2015, the country's gold reserves jumped by 57 percent after providing its first update on its gold holdings in six years. The People's Bank noted that its most recent purchase was made when gold prices were around $1,650 an ounce, suggesting that China spent nearly $1.69 billion to increase its gold reserves in October. Thanks in part to strong demand from central banks like China's People's Bank, gold prices have surged in recent weeks. As of early Dec. 7, gold in London cost $1,773 an ounce following a short-lived rally when an ounce cost around $1,800 for a few hours on Friday, Dec. 2. Watch this episode of "Redacted" as host Clayton Morris discusses why China is stockpiling gold. This video is from the ThriveTime Show channel on Brighteon.com.More related stories:

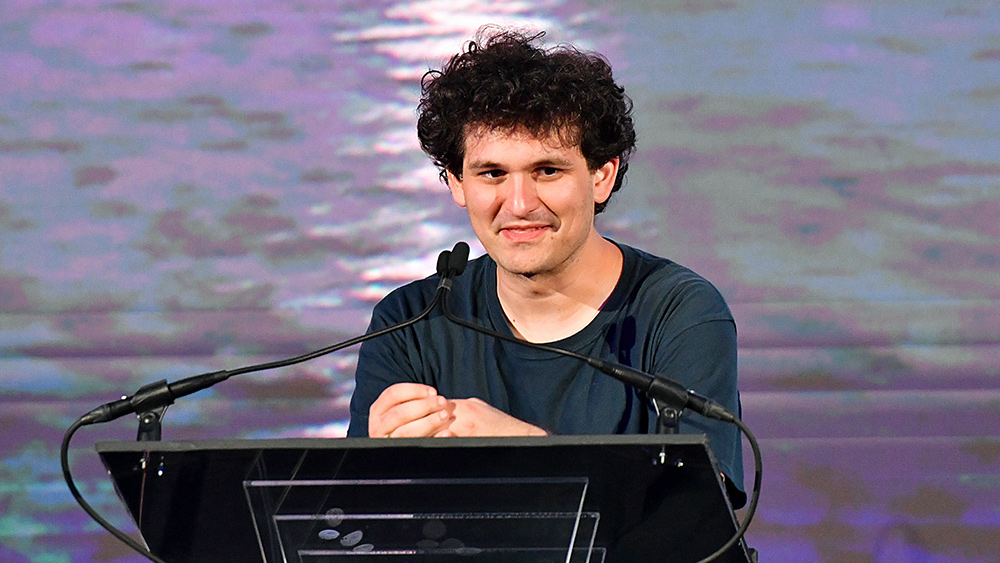

Health Ranger Report: John Perez highlights the importance of having silver and gold as crypto collapses. Health Ranger Report: Gold and silver can help safeguard your assets as COLLAPSE of traditional pension systems looms. Central banks continue adding gold to their net holdings as fears rise of a global currency collapse. With a 'double whammy' hitting the system and the market going down, have gold and cash on hand. The Right Side with Doug Billings: Invest in gold and silver during inflation, says Bob Reid – Brighteon.TV. Sources include: ZeroHedge.com Bloomberg.com Kitco.com Reuters.com Brighteon.comSEC reveals Sam Bankman-Fried squandered FTX missing funds on political donations and himself

By Belle Carter // Share

China sends 18 nuke-capable bombers into Taiwan’s air defense zone

By Kevin Hughes // Share

Ronna McDaniel’s RNC spent MILLIONS on private jets, limousines, booze, luxury retreats

By News Editors // Share

Alleged $100M stock manipulation scheme leads to charges against social media influencers

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share