Parler

Parler Gab

Gab

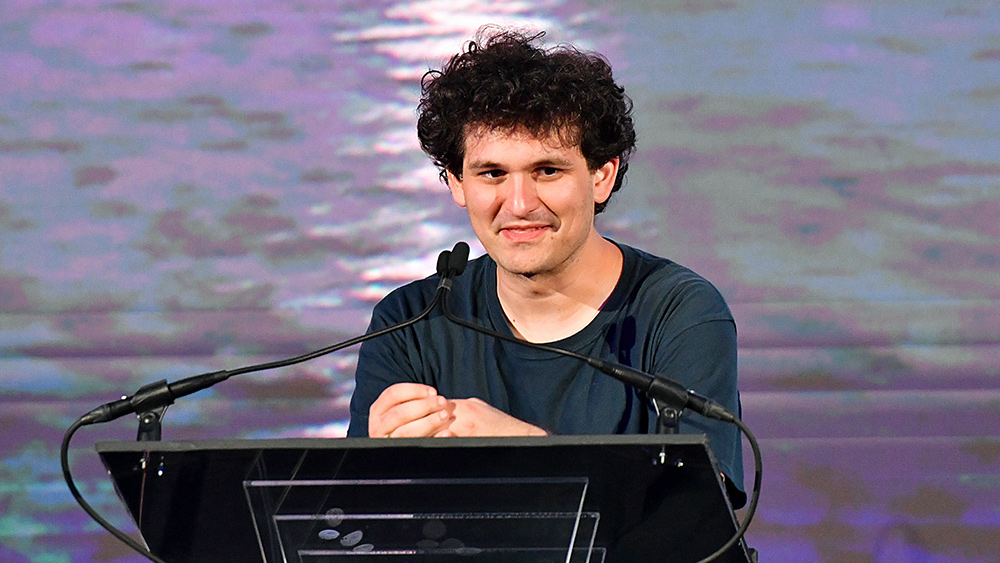

SOL's remaining value could collapse if FTX's holdings are liquidated

SOL's deep ties to FTX have turned it into a proxy for the collapsing company in the eyes of crypto traders. Its value has already nearly vanished from its peak of almost $80 billion in Nov. 2021 to just over $6 billion now. Furthermore, the Solana blockchain has been plagued by a series of mishaps, including hacks and outages. "I do worry about the impact this will have, given Alameda had large holdings in SOL that could get liquidated," said crypto entrepreneur Tristan Frizza. SOL is the second-largest holding of Alameda, representing about 10 percent of Solana's market cap. "Solana has a rough couple of days ahead of it. The immediate concern is that a lot of SOL could be sold off in the next 48 hours, as nearly 19 million tokens hit the market with Epoch 370, and those holders look to avoid any additional losses," noted Michael Safai, co-founder of cryptocurrency trading firm Dexterity Capital. "There's also the pressure that could come from borrowers potentially liquidating Solana to shore up balance sheets or meet demand from creditors." But Messari senior research analyst Tom Dunleavy believes Alameda has already liquidated a lot of its SOL holdings to raise capital, and that this decline could plateau in the next few days. "Longer term, Solana has a much more vibrant ecosystem of developers, second only to Ethereum," he said. Sources within Solana, who spoke with Fortune's crypto reporter Taylor Locke, support Dunleavy's analysis regarding Solana's future. "The focus internally continues to be moving forward and building," Locke wrote. He also quoted Solana co-founder Anatoly Yakovenko, who said that the company did not have any assets invested in FTX and is generally protected from its potential full collapse. Watch this episode of the "Health Ranger Report" as Mike Adams, the Health Ranger, talks to "Crypto Nostradamus" John Perez about the ongoing implosion in the cryptocurrency market. This video is from the Health Ranger Report channel on Brighteon.com.More related articles:

Report: Crypto exchange Binance still serving Iranian clients, allowing them to trade despite sanctions. CRYPTO CARNAGE: Bankman-Fried 'lent' billions in customer funds to his trading firm, setting the stage for implosion. Crypto ad spending down 99.9% since February as industry meltdown continues. Solana blockchain targeted in cyberattack, hackers stole $5.2 million worth of crypto assets from around 8,000 wallets. COINGEEK: Crypto crime cartel: FTX, Sam Bankman-Fried, Tether and Solana. Sources include: Yahoo.com Fortune.com CoinTelegraph.com BeInCrypto.com Brighteon.comPoland’s central bank predicts double-digit inflation until 2024

By Kevin Hughes // Share

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share