Parler

Parler Gab

Gab

Mainstream media portrays surge in inflation as temporary

The mainstream media largely mimicked these views, portraying the surge in inflation as a temporary shift higher due to the reopening of the economy. Interestingly, many news outlets claimed that former President Donald Trump's tariffs would raise prices. But consumer prices remained low throughout his administration as tariffs ended up getting absorbed by Chinese producers and exporters and the profit margins of large U.S. companies. Some of the same news outlets are now insisting that the price increases under Biden's administration are no big deal. They say that a silver lining of inflation would be higher wages. However, prices have been rising faster than wages – lowering the standard of living for many American families. Inflation continued to soar, sapping the credibility of the Biden administration and the central bank when it came to inflation. Late last year, Fed officials dropped the word "transitory" from their vocabulary and began signaling that they would raise interest rates this year.Fed official: Inflation could persist beyond 2022

In October last year, Atlanta Federal Reserve President Raphael Bostic said the sharp increase in prices tied to the Wuhan coronavirus (COVID-19) pandemic has expanded beyond just a handful of major goods and will not wane anytime soon. Bostic said at the time that he and his staff will no longer refer to the inflation as transitory because it could persist probably well into 2022 and beyond. He also pointed to worsening bottlenecks in supply chains, which is how businesses procure parts and supplies. Major shortages of many key materials have pushed prices higher, delayed production and forced businesses to charge more for their products. The public's perception of Biden's competence has collapsed. Many Americans interpreted the administration's confidence that inflation would pass to be a sign that it did not care about the hardships inflicted upon families paying more for food, fuel and other daily necessities. Attempts by the administration to blame corporate greed for high prices fell flat. And despite announcing the biggest ever release of oil from the government's emergency reserve, oil and gasoline prices continued to rise to the highest level in years.The Fed is expected to raise its target interest rate in March. Fed watchers are debating how many times the Fed will hike rates, with swaps prices now implying at least three and perhaps four hikes this year. However, many analysts think the Fed will hike five to seven times this year as inflation proves less tractable than officials believed.

Biden's approval rating falls as inflation rises

Polls show the public's rating of Biden's handling of the economy is at a record low. The president's overall approval rating has plummeted. Forty-five percent of Americans say inflation has put a strain on household finances. In December last year, a Fox Business poll showed that when it comes to rising prices, more than twice as many think the Biden administration's actions are hurting rather than helping – 47 percent think they are hurting and only 22 percent think they are helping. (Related: Poll: American voters blame Biden’s policies for making inflation worse as approval dips.) About 46 percent of poll participants also think Biden's proposed social spending plan would push inflation higher, while 21 percent think it would help lower inflation. That same survey revealed that more than eight in 10 Americans are extremely or very concerned about inflation. Also, about four in 10 say inflation is the biggest issue facing the economy – that's more than double the number who say government spending or income inequality.More related stories:

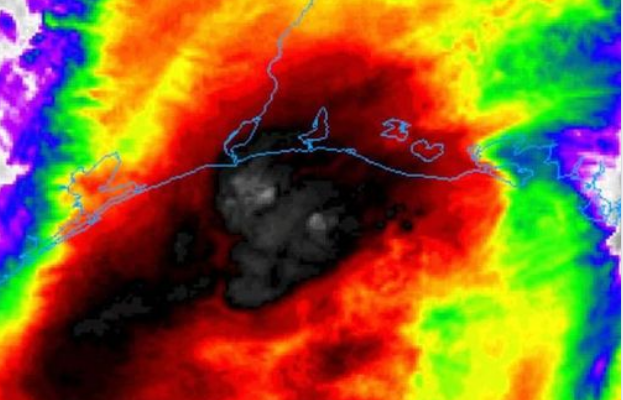

He doesn't listen: Obama admin advisers call out Biden for refusing to heed inflation warnings. Poll: Most voters consider Biden’s handling of the economy "poor" as inflation soars. INFLATION: Prices of groceries, gas rise as Biden’s money printing machine goes into overdrive. 45% of American households experiencing financial hardship thanks to Biden era inflation. Watch the video below to learn more about inflation in the U.S. and what the Biden administration is doing about it. This video is from the InforWars channel on Brighteon.com. Sources include: Breitbart.com MarketWatch.com FoxBusiness.com Brighteon.comThey are screwing with the weather maps: SUN is BAD!

By News Editors // Share

‘Openly queer teacher’ admits to socially transitioning 3rd grade students

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share