Parler

Parler Gab

Gab

- U.S. President Donald Trump announced a landmark trade agreement with Japan, calling it "the largest trade deal in history," which imposes a flat 15 percent tariff on all Japanese goods entering the U.S., including automobiles.

- In exchange, Japan has pledged to invest $550 billion into U.S. infrastructure, energy and manufacturing projects – a key component of the deal.

- Japan will open its market to U.S. agricultural and automobile imports, including rice, marking a major shift from its historically protectionist stance on food products.

- While auto tariffs are reduced under the deal, the existing 50 percent U.S. tariff on Japanese steel remains unchanged.

- Financial markets reacted sharply – Japanese stocks surged (Nikkei +3.5 percent), the yen fluctuated and Japanese government bonds fell steeply to 15-year lows; U.S. and European equities also gained on optimism.

Swift and varied movements seen in financial markets following the deal

In an immediate reaction to the U.S.-Japan trade deal, financial markets saw swift and varied movements across asset classes. Japan's Nikkei 225 rose to 3.5 percent, buoyed by double-digit gains in automakers such as Toyota, Honda and Mazda. U.S. equity futures climbed over 0.4 percent, while European auto stocks also rallied on speculation that Brussels could negotiate similar tariff terms. The Japanese yen initially firmed by 30 basis points but quickly reversed the gain. It then strengthened again following an NHK report on auto tariffs, only to give up that move as well. Japanese equities rallied, with the Topix index climbing as much as 2.5 percent, while U.S. equity futures also edged higher. S&P futures jumped 20 basis points and have largely held onto those gains. U.S. Treasury futures were offered at 111-09. The most pronounced market move came in Japanese government bonds (JGBs), where yields spiked sharply. JGB futures plunged 95 ticks to 137.65, breaking below last week's low, with support seen near 137.59. Trading volumes surged 18 percent above last week's levels. The next major technical support lies at 137.30, a level not seen in 15 years. UBS reported a strong sell bias on its trading desk, with flows skewed 1:10 toward selling, driven by the fallout from the trade deal. Attention now turns to the 40-year bond auction the next day, the first since Prime Minister Shigeru Ishiba's recent election loss. However, the selloff may be overdone and a solid auction could help stabilize the market. Follow Trump.news for similar stories. Watch the July 8 episode of "Brighteon Broadcast News" as Mike Adams, the Health Ranger, discusses Trump unleashing new tariff wars with an extra attack on BRICS nations.More related stories:

Trump unveils 25% tariffs on Japan and South Korea amid broader trade policy shift.

Trump imposes new tariffs on agricultural imports.

Canada RESCINDS DIGITAL TAX after Trump threatens retaliatory tariffs.

Sources include: ZeroHedge.com DeepNewz.com Brighteon.comThe tide turns: More G7 nations abandon Israel, rallying behind Palestinian statehood

By Lance D Johnson // Share

Trump slaps India with 25% tariffs over Russia ties, sparking trade war fears

By Zoey Sky // Share

Trump administration’s “Ticket Home” campaign: A new approach to immigration enforcement

By Belle Carter // Share

U.K. to recognize Palestinian state in September unless Israel acts to end Gaza crisis

By Laura Harris // Share

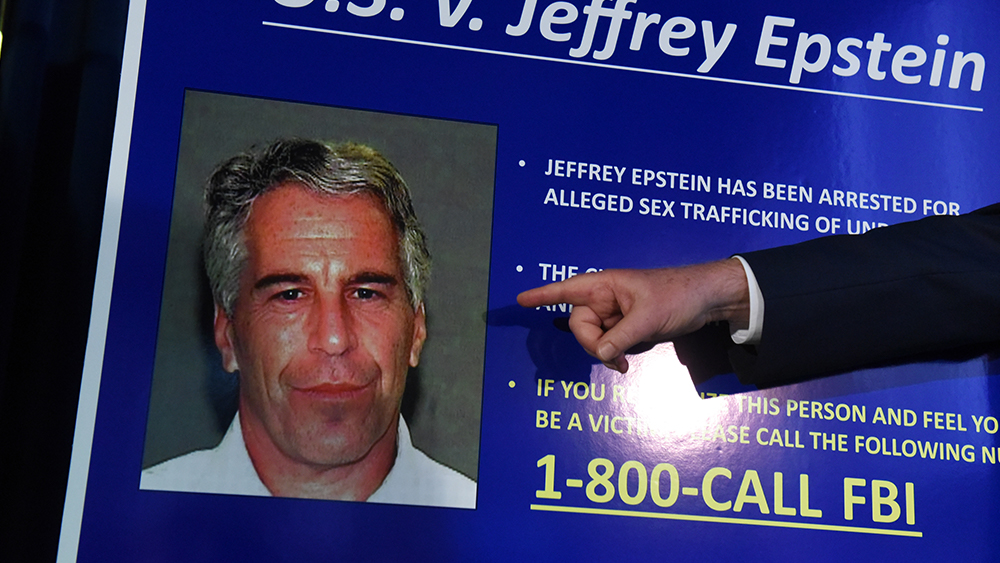

How the Epstein saga exposed a system built on silence

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share